When considering your physical health it may be your weight or your cholesterol level. When it comes to gauging your financial health, no figure is more important than your credit score! Unlike your weight, everyone from lenders to landlords to car dealers will know and evaluate that number if you want credit. It is used to decide whether to offer you a mortgage, an apartment, or that new car.

Like your weight and cholesterol, your credit score can fluctuate. It’s easy to tip the scales against you, and difficult to improve your score once you’ve done it. But if you educate yourself about how your score is calculated and become disciplined in your credit habits, you’ll be in much better financial health.

Your credit report lists all loans and credit accounts, past and present and how you handle them. Your credit score is all that data crunched into a three digit number. In Canada, credit scores range from 300 to 900 points; unlike your weight, the higher the number, the better, as it indicates less risk to the lender.

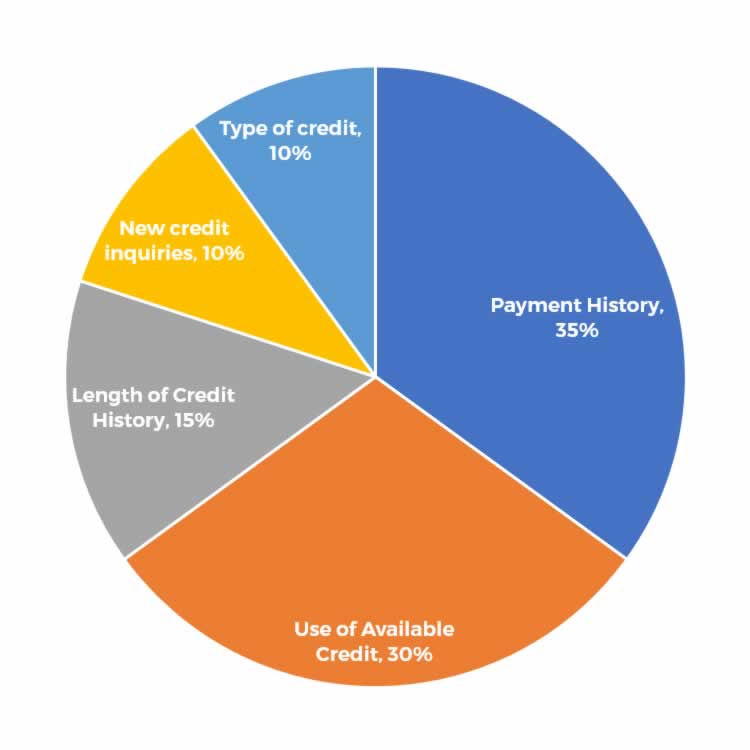

Your Credit Score Considers 5 Factors

Payment history – 35%

How you paid your debts in the past, the number of payments over 30 days late, together with any collections, judgments and bankruptcies.

Use of available credit – 30%

How much credit are you using (i.e. balance) compared to how much credit you have available (i.e. credit limit). If you borrow to the limit of all available credit, it could negatively impact your score.

Length of credit history – 15%

The longer you have had an account open and used it, the better your score.

New credit inquiries – 10%

Volume/type of recent inquiries – It is normal and expected to seek credit occasionally. Limit the number of times that you apply.

Types of credit – 10%

The number and types of accounts – It is better to have a mix of different types of credit (mortgage, car loan, credit cards and revolving credit accounts) as they all impact you differently.

While all these factors collectively determine your overall score, a significant 65% is determined by how you pay your credit and how much credit you have. To maintain or improve your credit score:

- Make payments on time

- Iif you cannot pay your bills in full, pay at least the minimum amount

- Limit the number of inquiries on your credit

- Do not go over your limit

- Do not carry balances close to your limit – try to use less than 35% of your available credit

Did You Know?

You can add a consumer statement of up to 100 words which provides details about an item on your report.

Everyone should check their credit at least once a year for errors and signs of identity theft; your own inquiries do not have an effect on your credit score.

Need More Information?

If you're interested in more information on this - or any topic related to home financing - please click on the button below.

Tagged with Credit, Credit Rating, Credit Score

BC & Alberta Mortgage Broker

Eva Poulson

When I'm not breaking the knuckles of different lenders for better mortgages for my clients - I'm kidding (or am I?) - you can usually find me visiting with friends or family, writing for this blog, or doing my best to keep from capsizing a dragon boat!